TexasVested Offering

Diversified Income-Producing Real Estate Investment Fund

The TexasVested Fund is focused on managing a diversified portfolio of stabilized, income-producing assets across Texas—including single-family flips, rentals, mobile home and RV parks, and private real estate-backed notes—while actively seeking similar opportunities to expand the portfolio. Unlike traditional funds that depend on speculative acquisitions or ground-up development, TexasVested is built on seasoned assets and performing notes contributed by the Fund’s sponsor, Brant Phillips.

Brant brings over 18 years of real estate investment experience, with a track record of more than 500 successful transactions and $50 million+ in real estate volume—all while maintaining a 100% loan performance history with his lenders.

Grounded by strong equity positions and consistent cash flow from day one, the Fund is designed to prioritize stability while offering long-term growth potential. Investors receive an 8% preferred return, plus 20% of net profits, distributed at the Manager’s discretion based on performance and market conditions.

This offering is structured to provide conservative, income-focused returns backed by real, performing assets—not projections or speculative assumptions.

Investment Strategies

TexasVested invests in seller-financed mortgage notes backed by affordable housing assets. These notes offer consistent monthly cash flow, strong collateral, and attractive yields—without the headaches of property management. In Texas, demand for owner-financed housing remains high, especially among underserved buyers who can’t qualify for traditional loans. These investments offer security, simplicity, and dependable income.

Our house flipping strategy targets entry-level and workforce housing—segments of the market with consistent demand, even in shifting economic conditions. We focus on modest, value-add homes in growing Texas markets, where renovation creates instant equity and attractive resale margins. These flips are short-term in nature and provide strong returns while helping improve housing access.

We invest in affordable single-family and small multifamily rentals across Texas. These properties offer dependable monthly income, long-term appreciation, and tax advantages like depreciation. In today’s housing market, renting remains the most viable option for many families—making affordable rentals a stable and scalable asset class for passive investors.

TexasVested originates short-term, real estate-backed loans to local investors and operators. These loans are secured by real property, underwritten conservatively, and offer high-yield interest (typically 10%+). Hard money lending allows us to generate strong income while helping other investors rehab properties and expand affordable housing across the state.

Mobile home parks are one of the most recession-resistant real estate asset classes—and Texas is a prime market for affordable housing. Our investments in MHPs focus on stabilized communities with long-term tenants, low turnover, and strong cash flow. With high demand, limited new supply, and lower operational costs, MHPs provide durable income and strong downside protection.

- Capital Preservation : Backed by hard real estate assets with conservative underwriting.

- Attractive Returns : 8% preferred return plus a 20% share of net profits (“equity kicker”).

- Real Asset Security : Investments are backed by income-producing Texas real estate.

- Strategic Acquisition Advantage : Land and assets acquired well below market value, creating built-in equity from day one.

- Diversification : Offers exposure beyond traditional stocks, bonds, and paper assets.

- Inflation Hedge : Affordable housing performs well during inflationary periods and market volatility.

- Recession Resilience : Demand for affordable housing rises during economic downturns.

- Multiple Exit Strategies : Our value-focused model allows us to hold, refinance, or sell based on market conditions.

- Mission-Driven Investing : Supports one of the most critical needs in real estate today—affordable housing access.

Who Should Invest?

- HNW (high net worth, accredited) individuals looking for a PASSIVE INVESTMENT in a stable, well-managed real estate asset.

- Private equity funds looking for DIVERSIFICATION into single-family development real estate.

- Anyone with a QUALIFIED RETIREMENT ACCOUNT such as self-directed IRAs and 401(k)s.

- HIGH-INCOME, BUSY PROFESSIONALS who have little time to learn how to invest in real estate but would like to enjoy the benefits of this type of investment.

- Individual investors looking for both Income via an attractive preferred return and GROWTH by participating in an investment that shares the upside upon exit.

Projected IRR:17%

Operators With Proven Track Record

Why Texas?

Submarket Overview

Texas continues to rank among the fastest-growing states in the nation, both in terms of population and economic strength. With over 30 million residents and four of the top 11 most populous cities in the U.S. (Houston, San Antonio, Dallas, and Austin), the state offers a powerful mix of affordability, opportunity, and long-term real estate demand. According to the U.S. Census Bureau, Texas gained nearly 9 million residents between 2000 and 2022—more than any other state.

This explosive growth is driven by pro-business policies, no state income tax, affordable housing, and a diversified economy anchored by energy, tech, healthcare, and logistics. Major companies—including Tesla, Oracle, Hewlett Packard Enterprise, and Toyota—have relocated to or expanded operations in Texas, further fueling job creation and inbound migration.

Demographically, Texas is young, diverse, and upwardly mobile. Over 35% of residents are under age 30, and the state has one of the largest shares of foreign-born residents in the U.S., contributing to a robust and varied labor force. With a relatively low cost of living and high quality of life, Texas continues to attract both working-class families and white-collar professionals.

This population surge, paired with rising interest rates and tight housing supply, is intensifying the demand for affordable housing options—including rentals, mobile homes, and seller-financed homes. That’s why Texas is not just a great place to live—it’s a smart place to invest.

Why Texas Vested?

First and foremost, America is facing an affordable housing crisis.

Secondly, Houston, well, we have a problem, and that problem is a lack of supply of affordable housing. As a matter of fact, currently the Inventory of homes for sale in Houston is only 2.2 months, the lowest level in 25 years.

The Texas Vested development will create a solution for at least 140 families through this development project where we will be working to develop an amazing and affordable community with 140+ homes on 1/2 to 1 acre lots priced in the $200,000-$230,000 price range. Thus enabling these hard working families to become homeowners within a budget they can afford, along with a nice chunk of land to call their own.

We are projecting a 4-5 year development phase from start to finish and we are offering our investors an 8% preferred return plus 30% equity/waterfall upon project completion.

We believe this development is well positioned to capitalize on the opportunity that is before us with the aforementioned supply crisis of affordable housing in our nation and in our local market.

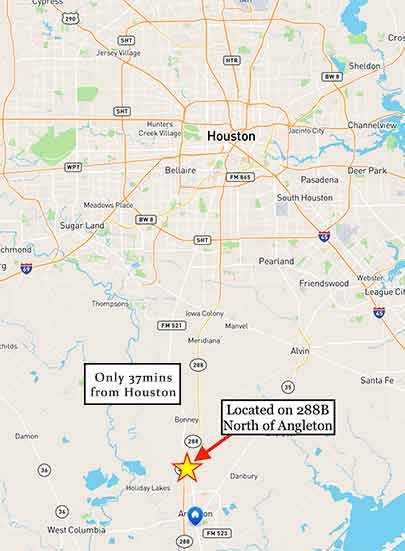

Furthermore, Texas Vested will be positioned on a prime location directly off of 288 B, north of Angleton and only 37 minutes from Downtown Houston! Btw, not only are we located directly off of 288B, but we also have Highway 48 on the east side of the development giving us 2 main thoroughfares for access and egress. This is another very attractive feature of this deal.

We have acquired the land at a remarkable price (acquisition price of $10k per acre) which has provided a solid foundation for a profitable project. Moreover, this property is not located in a Flood zone, unlike much of the undeveloped land in the Houston greater area.

Why Manufactured Housing?

In towns across the country, workers are struggling to make ends meet – and the high cost of housing is a big part of the problem.

Manufactured housing is already a major part of the solution. More than 22 million people in the U.S. live in manufactured housing — homes that are built to a federal standard in factories and typically placed on land that the homeowner owns or on rented lots in communities of manufactured homes. In many parts of the U.S., homes like these are the least expensive kind of housing available without a government subsidy.

Manufactured housing could do more to solve the housing shortage, but many communities have created rules that make building and maintaining manufactured housing more difficult. However, the quality of manufactured housing has increased a lot in the last three decades, and the latest generation of homes can look like homes in most neighborhoods. And new manufactured housing communities now often look like subdivisions of conventionally-built single-family homes.

Manufactured Housing Already Provides Housing for Millions of People

There are 8.5 million manufactured homes in the U.S. That’s nearly 10 percent of the nation’s housing stock, according to the Manufactured Housing Institute.

For people interested in buying a home, manufactured homes are the most affordable homeownership option available. Manufactured homes can cost half as much per square foot to build than site-built houses, according to U.S. Census data.

Houston median home price surpasses $300K as demand rises

HOUSTON – As construction costs and demand increase due to low interest rates and out-of-state buyers, the local median home cost rises as well.

In May 2021, the median price of single-family homes jumped 21.7 percent to $304,000, according to the Houston Board of Realtors. The average price rose 29.7 percent to $387,000.

HEB-anchored Manvel Town Center breaks ground – Houston Business Journal

“Manvel Town Center’s groundbreaking represents the beginning of not only one of the largest retail-focused projects in Houston’s history, it will be the largest project ever for Weitzman in our 31-year history,” said Herb Weitzman, executive chairman and founder of Weitzman.

Texas existing-home sales, prices increase as inventory shrinks faster than ever

COLLEGE STATION – Texas’ existing-home sales increased 2.5 percent month over month (MOM) to 29,000 transactions in May but remained more than 2,000 sales below peak levels reached at the start of the year.

HUD Secretary Fudge Reaffirms Her Commitment to Manufactured Housing

Senators from both sides of the aisle questioned HUD Secretary Marcia Fudge about manufactured housing today during a U.S. Senate Banking Committee hearing about housing and infrastructure

It’s Real Seguin Welcomes Texas’ First CrossMod Manufactured Housing Development

The first residential subdivision in Texas exclusively offering “CrossMod” manufactured homes is currently under development about four miles outside Seguin. CrossMod is the Manufactured Housing Institute’s trademarked name

Texas’ First CrossMod Manufactured Housing Development

In late 2016 MHI launched a two-phase strategic research and planning initiative. The goal was to identify underserved homebuyers and their needs and challenges for homeownership

Meet Our Sponsor

Brant Phillips

Brant has been investing in real estate since 2007. During this time he has invested in hundreds of deals ranging from rental properties, flips, owner finance notes, small commercial, an RV park, multiple mobile home parks and purchase/renovation of a small subdivision development. Brant is also the owner and founder of Invest Home Pro, a company that provides Investment, Construction, Education and Consulting services to Real Estate Investors.

Invest Home was recognized by Inc 5000 as one of America’s fastest growing companies in 2016. Brant has also authored several books related to real estate and has been featured on Fox News as a Real Estate expert and hosts local seminars and training events. Brant is a former police officer who prides himself on integrity and serving others. He is a husband and father of five and enjoys helping and teaching people to experience the freedom and success he has achieved through successfully investing in real estate.

Ready to Invest?, Or Just Learn More

Interested in the project but need more information?

Simply complete the form below and you’ll gain access to investment packet immediately.

Have Questions? Check Our FAQS

Development deals tend to run the gamut of risk/reward. Low risk investments are typically stabilized assets that have are considered ‘yield’ plays and tend to have a lower return and lower perceived risks. Other deals are “value add”, which take on more risk to make substantial improvements to a property, typically increasing both occupancy and rents. Development deals offer attractive returns at higher risk, and can encompass land entitlement, construction, and operation of a new facility. The important thing to decide here is not only about the outlook of the particular deal, but your own particular risk threshold.

As a limited partner investors take a passive role in the ownership of real estate commercial investments. Sponsors set up full construction management, handle taxes, finances, accounting, and an investor simply receives predetermined profit splits. It also has the advantage of limiting liability to amount invested due to passive nature.

Lower risk deals tend to have more stabilized values but produce cash flow over long terms that help meet investor cash flow goals. Value add development deals have a large profit potential but take on more risk to attempt those objectives.

-

LLC owns property

-

Investors own share in the LLC

-

Investors have no liability beyond their investment

-

Managers have all responsibility in managing the asset

Syndications allow one to invest only in products that match their investment objectives Funds generally invest in a portfolio of investments that may or may not meet investors objectives.

REITs are public securities with broad investment objectives that have the volatility of typical market securities. “Investors” can get in and out at will but have no long term commitments.

Leverage, more cash to invest elsewhere, not all eggs in one basket, more passive Benefit from the expertise, experience, and ability of the syndicator to qualify for loans, select from many opportunities, vet the deal, and execute the management of the investment for maximum return on investment.

The syndication establishes a corporation that purchases the asset and the investors own shares of the corporation. An LLC corporation manages the asset for the investors.

Only on the net income after all expenses and depreciation. The annual net income reported on a typical K1 already takes advantage of the depreciation shelter of the investment.

The future is hard to predict, but with an affordable housing development such as this, we have multiple exit strategies each lot that will be developed, based on our sponsors experience in the industry. In addition to selling the homes on land, we can also utilize other exit strategies to move lots including: selling lots directly to dealers, owner financing the homes on land and maintaining the note, owner financing the homes on land and selling the notes to note buyers, lease the homes, lease the homes and sell them to investors looking for cash-flow, and also lease options of the homes on land to owners and investors.

Your risk and liability is always limited to the amount of your original investment. If a cash call is required, you optional additional investment is typically limited to 10% of your original investment and that is optional.

Syndications are one of the most hands-off real estate investments available to investors. They allow investors to take a fully passive, limited partnership status alongside other limited partners in a clearly defined profit and revenue sharing structure. These syndications have managers, or sponsors, who take the active management responsibility, manage PMs, make liquidation decisions, and ultimately all day to day decisions of the property.

-

An accredited investor, in the context of a natural person, includes anyone who:

-

earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year, OR

-

has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence).

There are other categories of accredited investors, including the following, which may be relevant to you:

-

any trust, with total assets in excess of $5 million, not formed specifically to purchase the subject securities, whose purchase is directed by a sophisticated person, or

-

any entity in which all of the equity owners are accredited investors.

Please refer to the SEC website for additional information:

-

Most real estate syndications are offered under section 506 of Regulation D in the SEC’s manual. 506(c) offerings allow full solicitation to public forums, however they require all accepted investment partners to be accredited. 506(b) allows limited solicitation to a sponsor’s network, and thereby allows for both accredited and non-accredited investors to take part.

No, we do not.

From the following components:

-

Sponsor fees at close to cover our costs to filter and vet the best deals. (0.5% of acquisitions price)

-

In addition to that, we do not make any money until the sale of the property after investors original capital is paid back, and after all of the preferred returns are paid. The primary profits for the sponsor are only paid after the property has performed well.

Brant and David are both most proud of the fact that during their combined 35 years of investing in real estate, they have both maintained a 100% track record of performance to all of their lenders and commitments. This has not always been easy for either of them, but a focus on affordable housing and cash flow producing properties has helped them to weather the storms of up-and-down markets and also positioned them to capitalize on opportunities with their niche focus on serving America’s hard-working middle-class.

Learn more about the sponsors by viewing: https://texasvested.com/#

Confidentiality

This document/presentation contains Texas Vested’s proprietary and confidential information. It may not be copied, published, distributed, or transmitted, in whole or in part, by any medium or in any form without Texas Vested LLC’s prior written consent.

Securities Law Disclaimer

All information and materials in this report are for discussion purposes only. Nothing herein should be construed as an offer to sell or a solicitation of any offer to buy any securities. Offers are made only by private placement memorandum or other offering materials.

To obtain further information, you must complete our investor questionnaire and meet the suitability standards required by law.

- 1334 Brittmoore Rd Houston, Tx 77043

- 713-843-7172

- brant@texasvested.com

The material on this website is for the general information of our clients and visitors. This website does not constitute an offer to sell or a solicitation of an offer to buy or sell any security or investment product, and may not be relied upon in connection with any offer or sale of securities. Nothing on this website is a recommendation that you purchase, sell or hold any security, or that you pursue any investment style or strategy. Nothing on this website is intended to be, and you should not consider anything on the website to be, investment, accounting, tax or legal advice.